This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Cloud Computing

Mainframe vs. Server: How Are They Different?

Cloud Computing

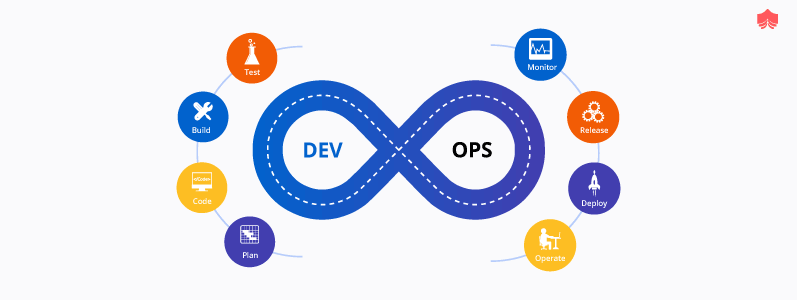

DevOps As A Service AWS

Artificial Intelligence

How AI can Improve Cloud Computing?

Cloud Computing

What are the Characteristics of Big Data?

Cloud Computing

Top 5 Big Data Challenges

Cloud Computing

Capgemini vs Deloitte: Which is best for cloud services?

Cloud Computing

Cloud Readiness Assessment: A Comprehensive Guide

Cloud Computing

What is Disaster Recovery in Cloud Computing?

Cloud Computing

V2Cloud Review: Pros, Cons and Alternatives

Cloud Computing

Cloud Performance Testing: A Comprehensive Understanding

Cloud Computing

Openstack VS CloudStack: Comparing Similarities and Differences

Cloud Computing

Business Agility in Cloud Computing

Digital Marketing

Cloud Computing for Marketing: How the cloud helps marketers in 2022?

Internet Technology

What is virtualization in cloud computing?

Cloud Computing

Cloud Computing and SEO Impacts

Internet Technology

What is the Cloud Computing Performance Metrics in 2022?

Cloud Computing

Deloitte vs PwC Comparing Cloud Services and Consulting

Internet Technology

Cloud Forensics Basic Concepts and Tools in 2022

Cloud Computing

Accounting for Cloud Computing Arrangements

Cloud Computing

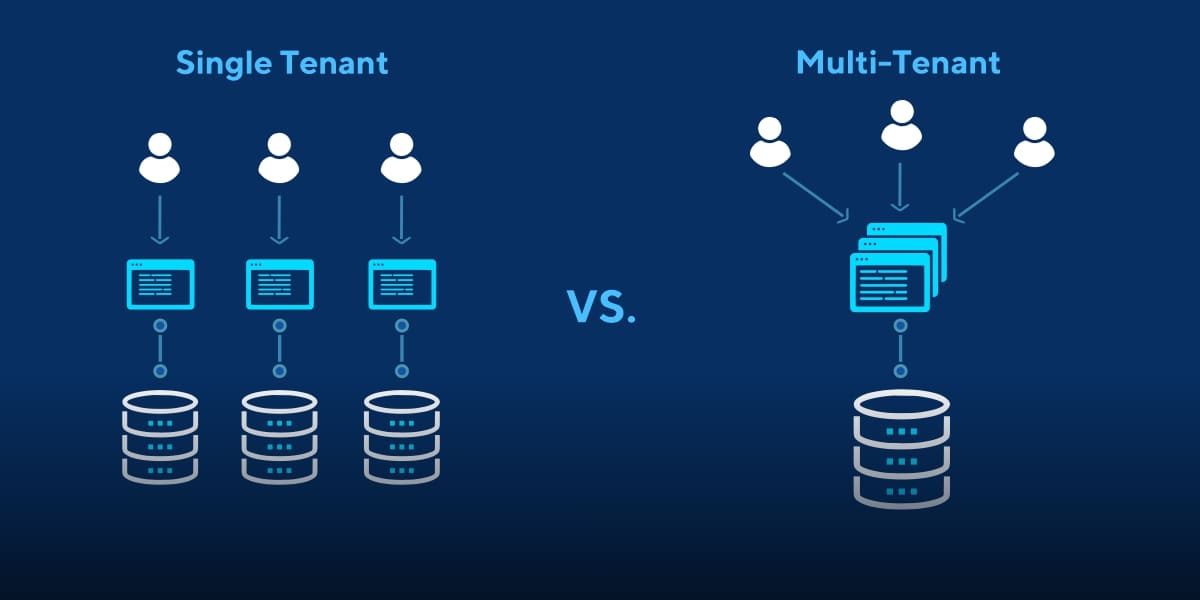

Important Multi-Tenancy Issues in Cloud Computing

Cloud Computing

What Is Lift And Shift Cloud Migration?

Internet Technology

Top 10 Best Cloud Gaming Services of 2022

Internet Technology

Best Cloud Security Tools in 2022

Internet Technology

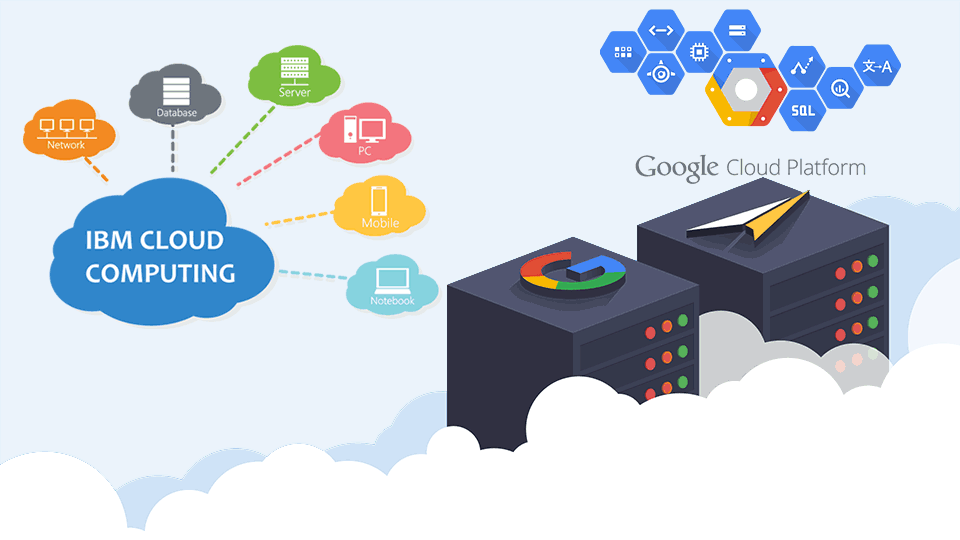

Alibaba Cloud vs AWS: A Comprehensive Comparison [2022]

![Alibaba Cloud vs AWS: A Comprehensive Comparison [2022] 27 Alibaba cloud vs aws](https://www.eescorporation.com/wp-content/uploads/2021/09/Alibaba-Cloud-vs-AWS-Comparison.jpg)

Cloud Computing

Cloud Dev Environments: Best Cloud IDEs in 2022

Cloud Computing

Deloitte vs Cognizant: Consulting and Services Comparison 2022

Cloud Computing

How to Improve AWS Cost Optimization in 2022?

Cloud Computing

What legal issues in cloud computing could have to face?

Cloud Computing

Personal Cloud Computing: Why should one have a personal cloud?

Cloud Computing

What will Happen if there is No Cloud Computing ?

Cloud Computing

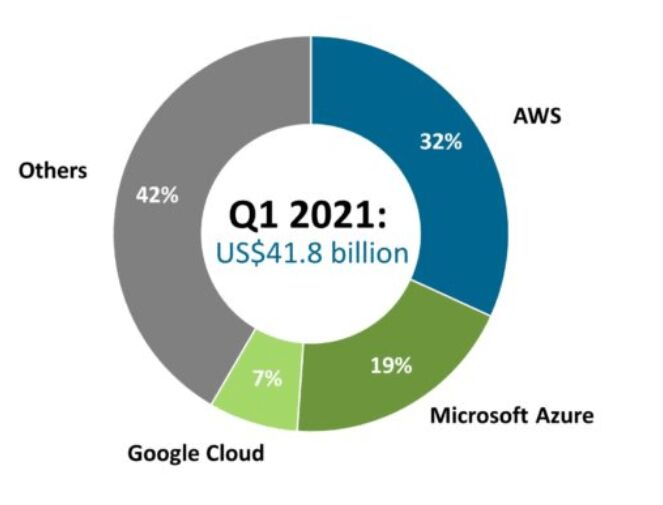

Public cloud market share statistics in 2022

Cloud Computing

Cloud computing optimization: Why is it important?

Cloud Computing

Infosys Vs. Accenture: Working and Cloud Services Compared

Cloud Computing

Migrating e-commerce to cloud: Benefits, And Tips

Cloud Computing

Cloud computing in Robotics: How is Cloud Empowering Robotics?

Cloud Computing

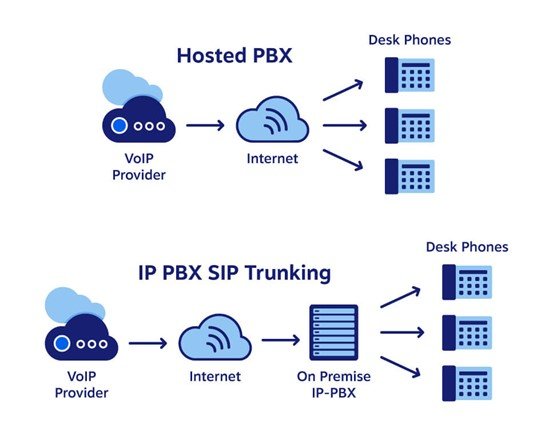

What is Cloud PBX and How does it work?

Cloud Computing

Cloud Native Computing vs Cloud Computing

Cloud Computing

Best Practices For Effective DevOps In The Cloud

Cloud Computing

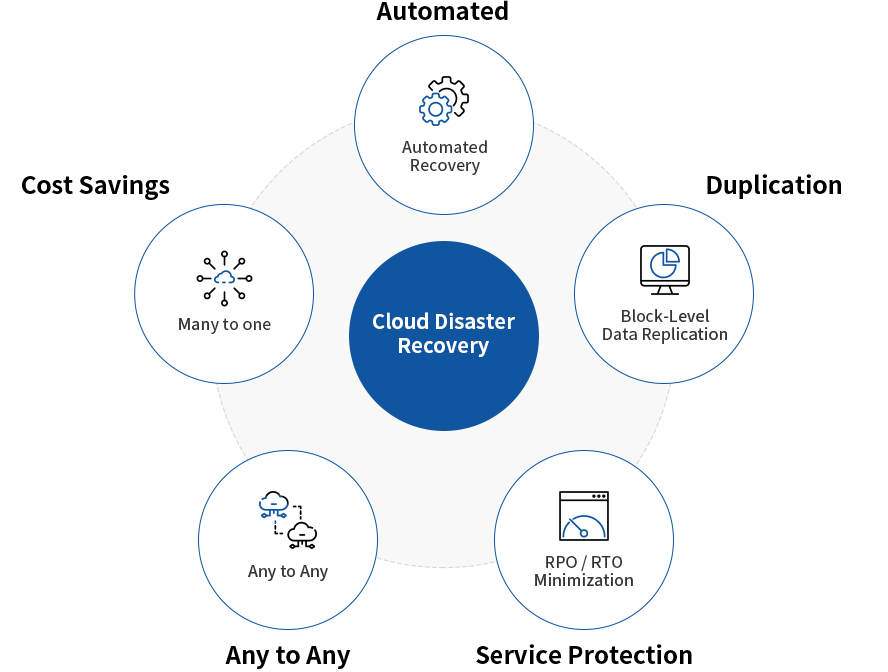

Cloud Disaster Recovery Best Practices

Cloud Computing

The Need of Cloud Computing Applications in the Banking Industry

Internet Technology

Amazon Web Services : Best Security Tools 2022

Internet Technology

COVID-19 and Cloud Computing: 7 Important Business Benefits on Healthcare

Internet Technology

What Is The Difference Between A Data Center And Cloud Computing?

Internet Technology

Cloud Storage Vs Cloud Computing: What’s the Difference?

Cloud Computing

How Much Does Cloud Computing Cost?

Cloud Computing

Cloud-based Organizations are Managing Better in COVID-19

Internet Technology

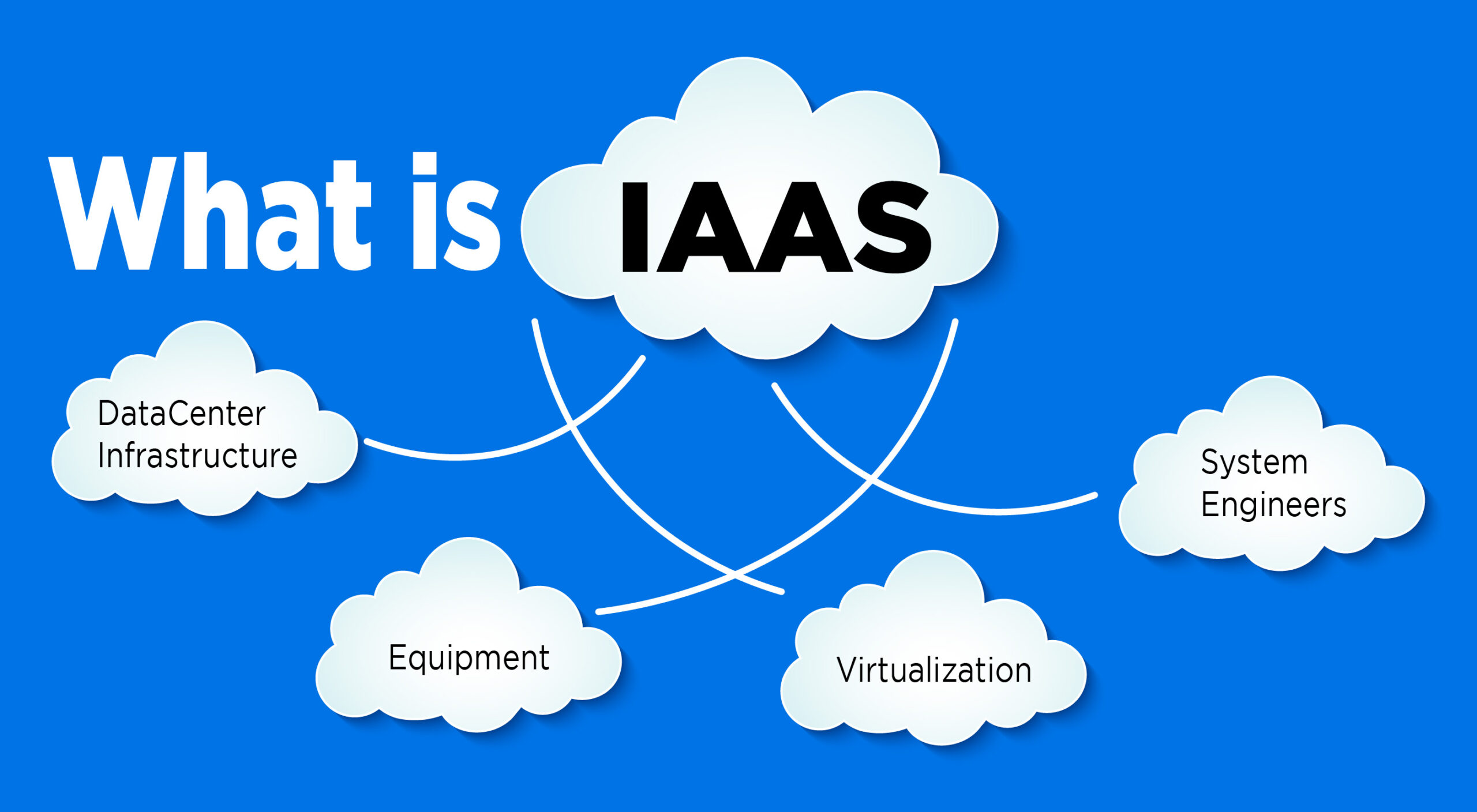

Infrastructure as a Service Use Cases: 6 Powerful Business Attributes

Cloud Computing

10 Cloud Computing Applications in 2022

Cloud Computing

Best Amazon Storage Services and its Advantages

Cloud Computing

Limitations of Cloud Computing and its 5 Disadvantages

Internet Technology

Cloud Storage Benefits: Helping You Increase Productivity in 2022

Internet Technology

Cloud security – A Detailed guide

Internet Technology

Public Cloud in 2022: Understanding The Benefits and Disadvantages

Internet Technology

Amazon Web Services: The 3 Storage Solutions Driving Cloud Services

Internet Technology

Why You Should Choose Google Cloud Computing Services vs AWS

Cloud Computing

35+ Cloud Computing Statistics, Facts & Trends for 2022

Internet Technology

Public Cloud vs Private Cloud – A Comprehensive Comparison

Cloud Computing

5 Best Cloud Computing Services Companies in 2022

Cloud Computing

Cloud Computing Overview – Defining a New Era of Technology

Cloud Computing

Cloud computing applications in agriculture

Cybersecurity

How to Detect and Prevent Email Security Risks in 2023?

Cybersecurity

Cybersecurity Laws And Regulations In US [2023]

![Cybersecurity Laws And Regulations In US [2023] 77 Cybersecurity Laws And Regulations In US](https://www.eescorporation.com/wp-content/uploads/2023/02/4-1.png)

Artificial Intelligence

How to Use AI and Machine Learning for Cyber Security?

Cybersecurity

Mitigating Mobile Malware Attacks with MDM

Cybersecurity

What are NYDFS Cybersecurity Regulations?

Cybersecurity

Types of Security Controls

Internet Technology

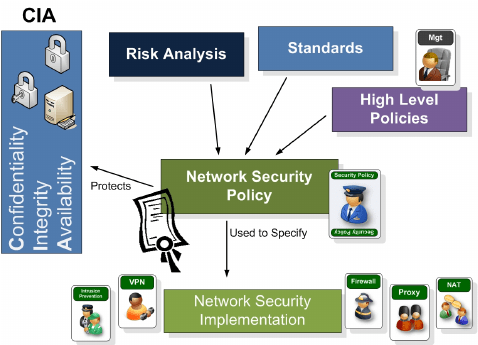

Network Security Policy: A Definitive Guide

Cybersecurity

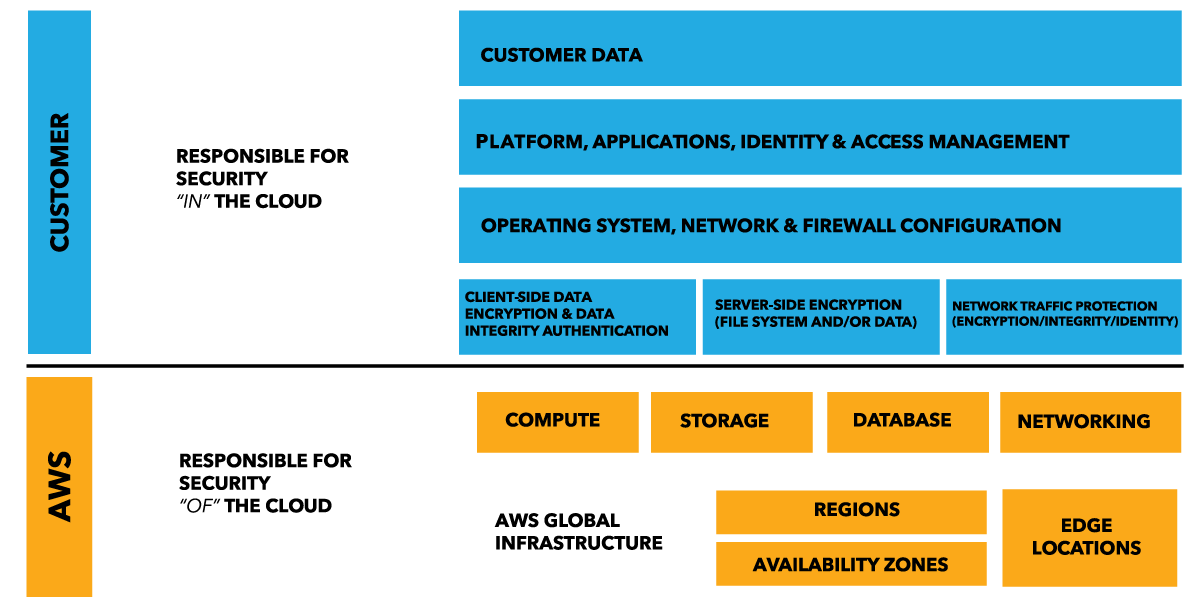

Shared Responsibility Model In Cloud Security Explained

Cybersecurity

Cybersecurity Compliance: What, Why, and How in 2022?

Cybersecurity

9 Best Cybersecurity Podcasts to Follow [2023]

![9 Best Cybersecurity Podcasts to Follow [2023] 85 Cybersecurity Podcasts](https://www.eescorporation.com/wp-content/uploads/2021/10/CyberSecurity-Podcasts.jpeg)

Internet Technology

Best Cloud Security Tools in 2022

Cybersecurity

US Cybersecurity Statistics You Should Know In 2022

Cybersecurity

EV Cyber Security: How Secure Are Electric Vehicles?

Cybersecurity

Cyber Security Checklist to Make Smart Home Network Safe

Cybersecurity

Security Issues In Cloud Computing and Its Solution

IT Staffing

Guide To Hiring A Digital Marketing Talent

Digital Marketing

Cloud Computing for Marketing: How the cloud helps marketers in 2022?

Digital Marketing

Facebook Vs LinkedIn: Which is best for B2B marketing?

Datacenter Networking

Datacenter Marketing: Best Plan, Strategy and 10 Ideas

Digital Marketing

Why You Should Start Building Your Brand Strategy? Things to Consider

Digital Marketing

Top 5 Benefits of Enterprise SEO Services

E-Commerce

How is Machine Learning used in E-Commerce?

Cloud Computing

Migrating e-commerce to cloud: Benefits, And Tips

Artificial Intelligence

How AI can Improve Cloud Computing?

Artificial Intelligence

How Artificial Intelligence will Transform Business?

Artificial Intelligence

How to Use AI and Machine Learning for Cyber Security?

Artificial Intelligence

Why is AI Consulting Becoming Important?

Artificial Intelligence

How Artificial Intelligence is Transforming the World?

Artificial Intelligence

What Are The Benefits of Artificial Intelligence?

Artificial Intelligence

How to Use Artificial Intelligence Against Cyber Attack?

Artificial Intelligence

What are the Challenges of Artificial Intelligence?

Artificial Intelligence

How Artificial Intelligence Works with Web Design?

Artificial Intelligence

Artificial Intelligence in Business

Artificial Intelligence

What Are Explainable AI Principles?

Artificial Intelligence

Benefits of narrow artificial intelligence

Artificial Intelligence

25+ Artificial Intelligence Statistics and Facts In 2022

Artificial Intelligence

The Pros and Cons of Artificial Intelligence In Mobile Apps

Information Technology

Understanding How AI Can Enhance Datacenter Security: 8 Powerful Attributes

Business Intelligence

How would the Technology Industry use Business Intelligence?

Business Intelligence

What is the Future of Business Intelligence?

Decision Intelligence

Top Business Strategic Priorities To Be Followed By Business Leaders

Business Intelligence

Tips to Hire Business Intelligence (BI) Professionals

Business Intelligence

Business Intelligence Tools & Business Analytics: Important Facts You Must Know

Business Intelligence

Decision intelligence vs. business intelligence: How do both differ and relate?

Cloud Computing

Mainframe vs. Server: How Are They Different?

Datacenter Security

Tips for Hiring the Best Data Center Talent/Technicians

Datacenter Networking

What is Network Infrastructure Security?

Datacenter Networking

Network Servers Installation and Configuration: Essential Tips

Datacenter Networking

Network congestion: Introduction, causes, and solution

Datacenter Networking

Datacenter Tiers Classification Level (Tier 1,2,3,4)

Datacenter Networking

10+ Datacenters Statistics: Mind Blowing Facts and Figures

Datacenter Networking

How are Data Centers Connected to the Internet?

Datacenter Networking

Data Center Networking with Multipath TCP

Datacenter Networking

Datacenter Marketing: Best Plan, Strategy and 10 Ideas

Datacenter Networking

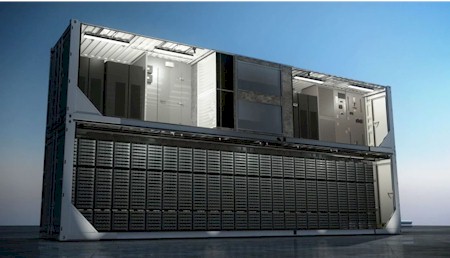

Pros and Cons: Containerized Data Center

Datacenter Networking

Colocation Data Center Guide – Overview, Merits And Demerits

Internet Technology

What Is The Difference Between A Data Center And Cloud Computing?

Datacenter Networking

Important Datacenter Network Topology Types Leading Business in 2022

Datacenter Networking

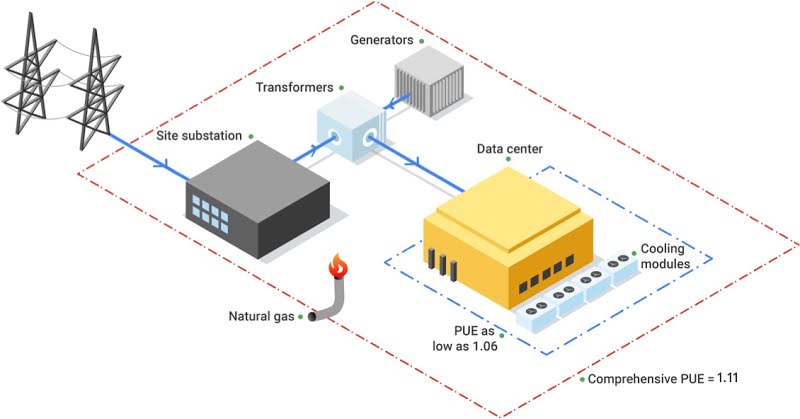

Energy Efficiency in Data Center Networking: 8 Helpful Solutions

Datacenter Networking

Visual Data Modeling in Datacenter Networking: Important Features You Must Know In 2022

Datacenter Networking

7 Important Datacenter Networking Challenges You Would Loved to Know in 2022

Datacenter Networking

3 Data Center Networking Tips You Should Know

Datacenter Security

Tips for Hiring the Best Data Center Talent/Technicians

Datacenter Security

What Are The Data Center Security Levels?

Cybersecurity

Types of Security Controls

Datacenter Networking

10+ Datacenters Statistics: Mind Blowing Facts and Figures

Information Technology

The Top 4 Data Center Security Best Practices

Information Technology

Understanding How AI Can Enhance Datacenter Security: 8 Powerful Attributes

Datacenter Security

All You Need to Know About The Top 5 Datacenter Security Solutions

Datacenter Security

5 Ways to Improve Datacenter Security

Information Technology

Datacenter Vulnerabilities: 7 Life-Changing Attacks You Must Know

Datacenter Security

Important Network Infrastructure Security Trends For 2022

Datacenter Security

10 Best Data Center Security Tips You Should Know

Decision Intelligence

Top Business Strategic Priorities To Be Followed By Business Leaders

Information Technology

6 IT Management Traps To Avoid At All Costs

Information Technology

Guide On How to Hire Robotics Engineer

Machine Learning

How to Recruit Machine Learning Talent

Information Technology

How To Choose The Right Staffing Firm?

IT Staffing

Guide to Evaluate IT Candidates Remotely

IT Staffing

Guide To Hiring A Digital Marketing Talent

Information Technology

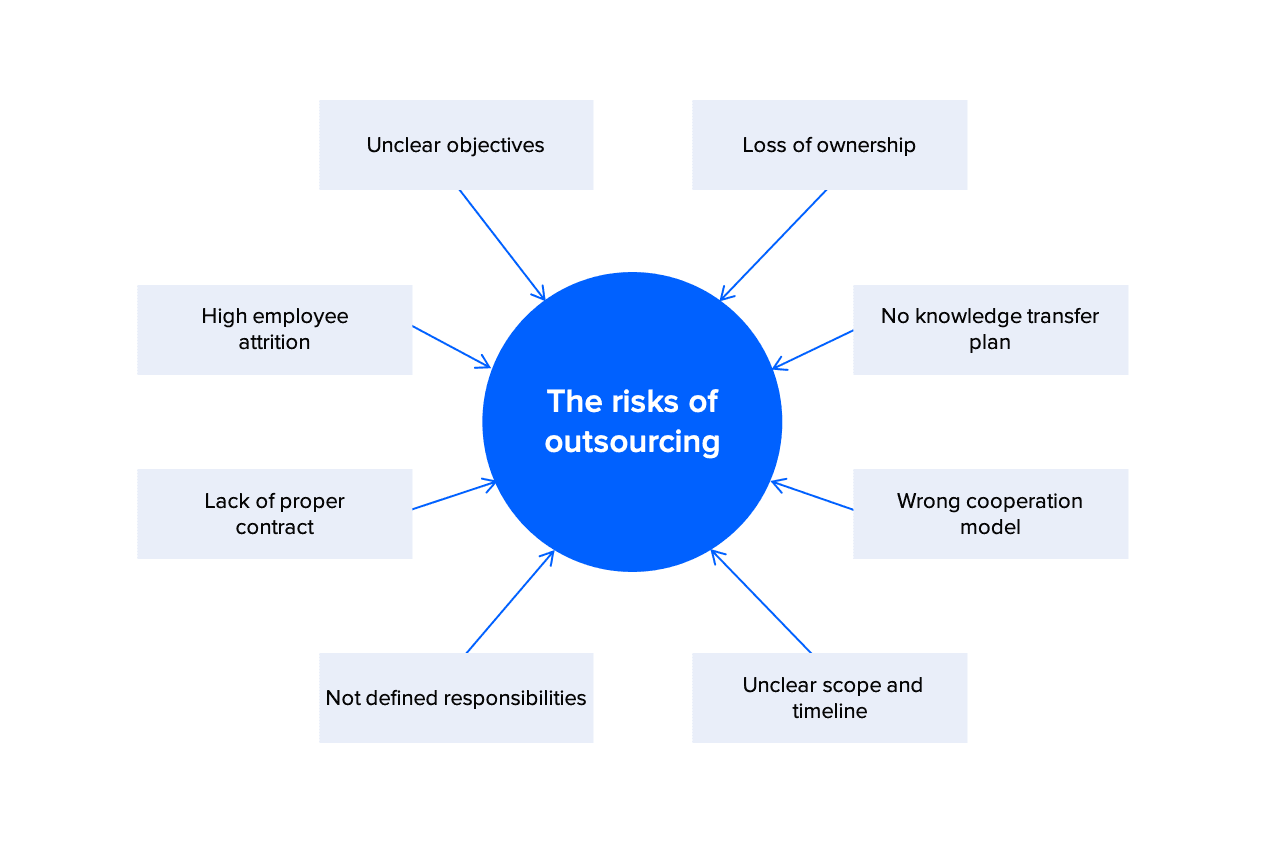

What are the Major Risks of outsourcing IT Services in 2022?

IT Staffing

Most Common Challenges In IT Recruitment

IT Staffing

How Can Cloud Computing Benefit IT Staff?

IT Staffing

Temporary vs Permanent IT Staffing: Pros & Cons

Information Technology

Why You should Invest in IT Training and Skill Development of Your Team?

E-Commerce

How is Machine Learning used in E-Commerce?

Machine Learning

What are the Business Benefits of Machine Learning?

Artificial Intelligence

How to Use AI and Machine Learning for Cyber Security?

Machine Learning

How is Machine Learning going to Impact all other Industries?

Machine Learning

How to Recruit Machine Learning Talent

Machine Learning

The Role of Machine Learning In Recruitment Process

Machine Learning

Best Data Cleaning Techniques In Machine Learning In 2022

Information Technology

30+ Amazing Machine Learning Statistics and Facts in 2022

Virtual/Augmented Reality

How is VR Used in Marketing?

Virtual/Augmented Reality

How is Virtual Reality different from Augmented Reality?

Virtual/Augmented Reality

How Does Augmented Reality Work?

Virtual/Augmented Reality

Augmented Reality vs Virtual Reality vs Mixed Reality

Virtual/Augmented Reality

5 Top Tools For VR And AR Development

Virtual/Augmented Reality

Ar and VR in Education: Extended Reality Uses

Cloud Computing

Accounting for Cloud Computing Arrangements

Financial Technology

10+ Fintech Statistics & Facts for 2022

Financial Technology

Do Robo Advisors Use Artificial Intelligence(AI) ?

Autonomous Systems

Reliability and Safety Aspects of Autonomous Systems

Electric Vehicle technology

EV Market Statistics and Forecasts for 2022 and Beyond

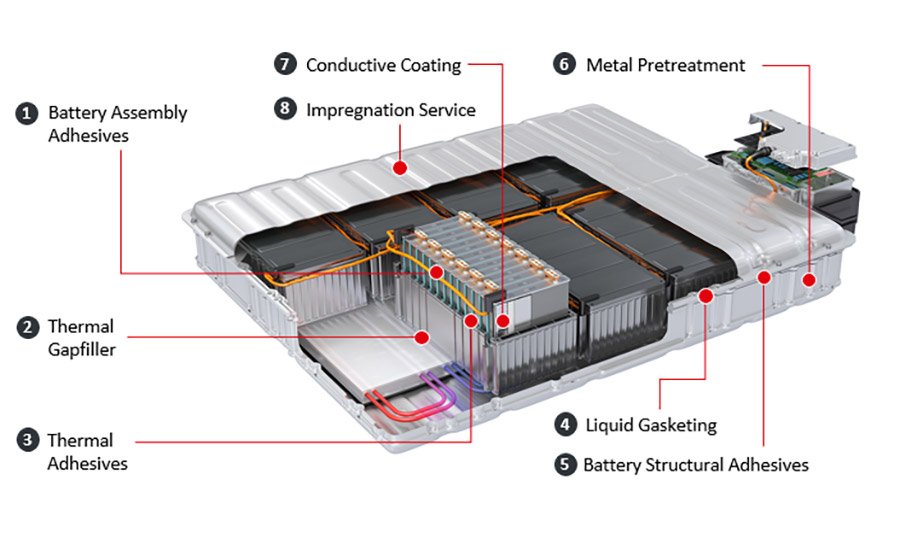

Electric Vehicle technology

Electric Vehicle Battery Technology Types And Their Cost

Electric Vehicle technology

How well do electric cars hold their value?

Cybersecurity

EV Cyber Security: How Secure Are Electric Vehicles?

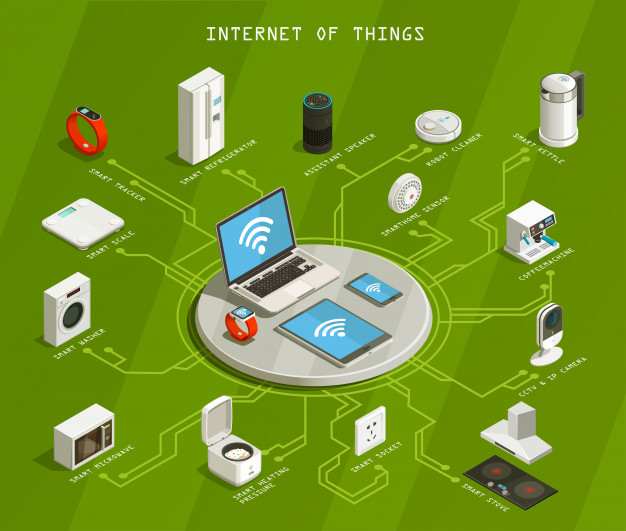

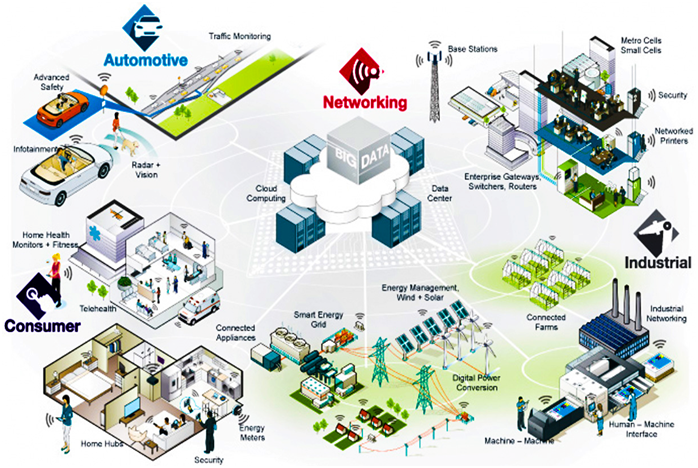

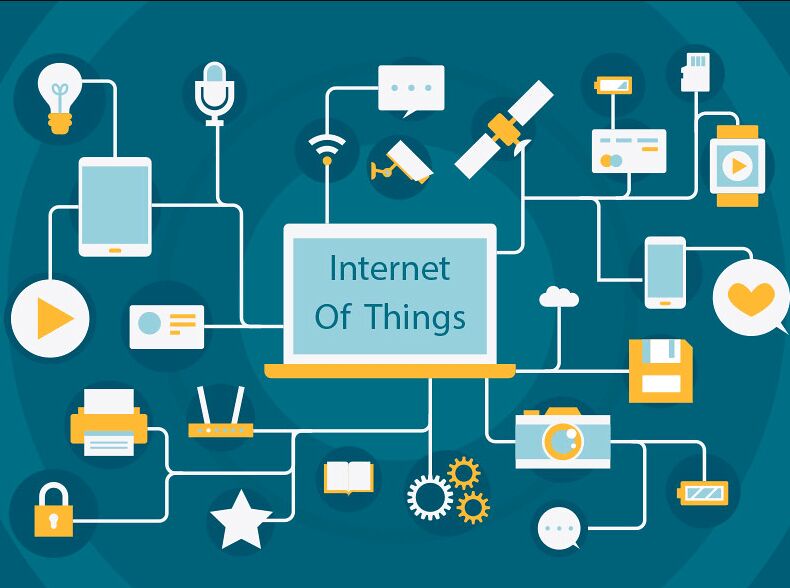

Internet of Things

How Does IoT Impact Our Lives In Smart Homes And Cities?

Engineering Technology

5 Astonishing Key IOT Statistics to know in 2022

Internet of Things

Advantages of Internet of Things: 6 Benefits You Should Know

Internet of Things

How does IoT work? The 4 key components You Should Know.

Internet of Things

Internet of Things Examples: 12 Practical Ways To Better Your Understanding

Internet of Things

Top 20 Internet of Things Facts You Should Know

Internet of Things

Top 10 Applications of Internet of Things. Practical Benefits

Quantum Computing

Quantum Computing in Cloud Computing: Their Relation and Future Scope

Renewable Energy

12 Ways Businesses Can Save Energy

Information Technology

Guide On How to Hire Robotics Engineer

Cloud Computing

Cloud computing in Robotics: How is Cloud Empowering Robotics?

Self-Driving Technology

Do Self-Driving Cars use Artificial Intelligence(AI)?

Internet of Things

How Does IoT Impact Our Lives In Smart Homes And Cities?

Smart homes

A Smart Home Checklist for Must-Have Devices

Cybersecurity

Cyber Security Checklist to Make Smart Home Network Safe

Software Engineering

Capgemini vs Infosys: Cloud and IT Services and Consulting Comparison

Software Engineering

10 Must-Know Features of a Great Mobile Application

Software Engineering

10 Best Project Management Tools For Software Development in 2022

Software Engineering

Feather Magazine Theme Vs Image Gridly Theme- A Comprehensive Comparison

Cloud Computing

10 Cloud Computing Applications in 2022

Systems engineering

How System Engineering Help In Risk Management